In 2013, a brilliant entrepreneur by the name of Pieter van Rooyen conceived an idea to repurpose a method used to enable secure, wireless voice telecommunications to a new task: processing genomic data.

At that point in time, it was not uncommon for it to take nearly 12 hours of computational time to identify mutations in a genetic sequence. This not only created a critical bottleneck to the important work being done by researchers and medical professionals, it also stymied the growth of the entire genomics industry. Pieter van Rooyen’s concept offered the potential to change this status quo.

Later that year, with the financial backing of select family offices (a family-controlled investment group), a new company—Edico Genome—was launched, with van Rooyen taking the helm as CEO. Greg Lucier, who was part of the original investor group, took on the role of Chairman of the Board.

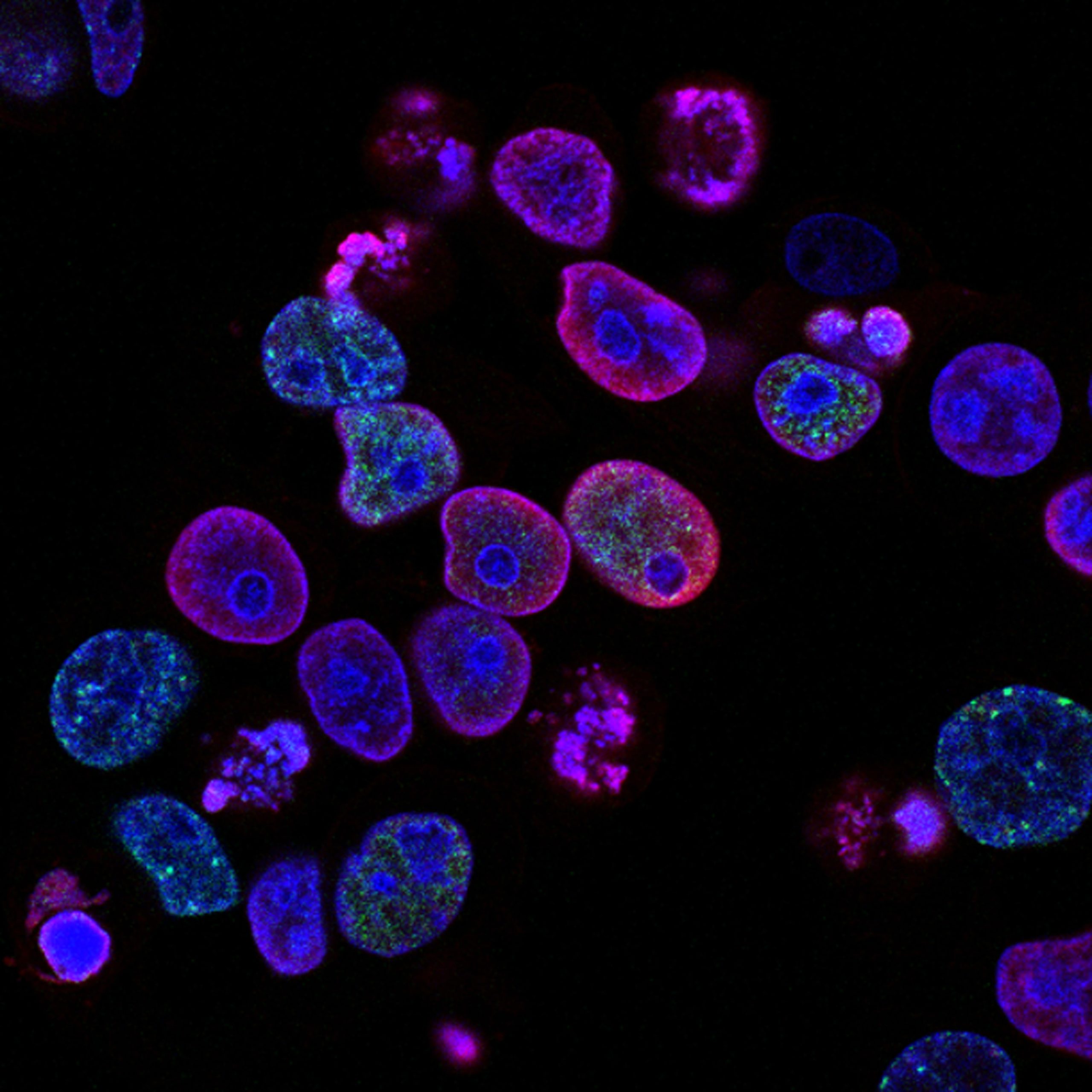

Just four years later, the team successfully created a specialized field-programmable gate array (FPGA) semiconductor device that reduced the computational time needed to identify genetic variants from 11 hours to under 30 minutes. Marketed commercially as DRAGEN—an acronym for Dynamic Read Analysis for GENomics—the new processing platform radically altered the workflow of genetic sequencing being performed at genomic centers around the world. It was also selected by Genomics England to be the official analysis platform for the UK government’s 100,000 Genomes Project, an effort aimed at enabling new scientific discoveries and medical insights into rare diseases, some common types of cancer, and infectious diseases.

To achieve this incredible and rapid success, van Rooyen and Lucier worked in close partnership to build a world-class board, hire a stellar management team, and leverage Lucier’s network of business relationships to open doors and opportunities for the company.

With an eye on the strategic value that Edico Genome’s technology and talented team would bring to its portfolio, Illumina (ILMN) acquired the company in 2018 for $100 million. This amount represented a 3X return to the company’s venture capital and individual investors.